Economic policy

Raw materials for electromobility

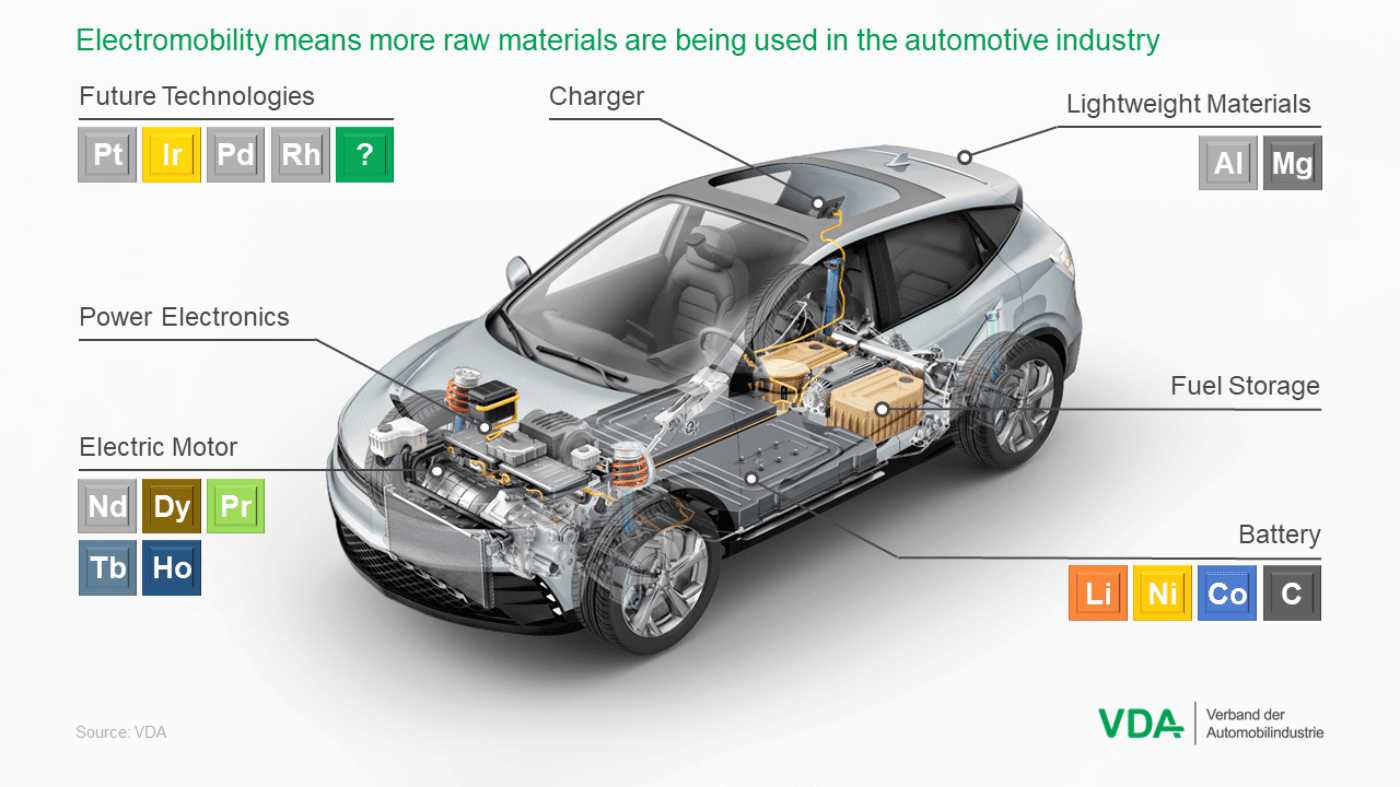

As electromobility ramps up, the automotive industry will require more raw materials than before. Among others, these include the battery raw materials as well as rare earths for permanent magnets. Aluminum and magnesium are central components of the value chain for lightweight construction.

- Topics

- Economic policy

- Raw materials

Battery-electric mobility, a key technology for achieving climate protection goals in the transport sector, uses materials that have previously only been used to a limited extent or not at all in the automotive industry. The most important components of electric cars and other electric vehicles are the traction battery and the electric traction motor. Raw materials such as lithium, cobalt, nickel, manganese and graphite are required to produce batteries. These are new raw materials in the automotive value chain. In addition to copper, rare earths such as neodymium, praseodymium and dysprosium are used in the permanent magnets for the electric motor.

Ensuring supply with strategic raw materials for electromobility

The increasing demand for these predominantly metallic raw materials could lead to bottlenecks along the value chain, at least temporarily. In addition, if demand increases and supply remains the same, a price increase can be expected. Therefore, for the success of Germany as a mobility location, reliable and price-stable availability of these raw materials is necessary. Electric cars are creating significant demand pressure on these raw material markets.

Many countries around the world also see the supply of critical raw materials as a security risk. The Russian war of aggression against Ukraine made it clear to the European Union that we should not be too dependent on a single supplier country when it comes to the supply of energy raw materials. These dependencies can be even more drastic when importing strategic raw materials. The Democratic Republic of Congo has a global market share of over 60 percent when it comes to cobalt supply. China has a global market share of around 80 percent for rare earths. Companies' efforts to diversify their supply chains for strategic raw materials are becoming increasingly difficult. Countries are increasingly introducing protectionist measures and restricting or even banning the export of strategic raw materials, such as Indonesia for nickel or China for germanium and gallium.

The VDA sees an immediate need for political action here to ensure the competitiveness of European industry and to achieve climate protection goals. Specifically, it involves the following measures:

Creating options in the global raw materials market requires large-scale stimulus from political institutions. A strategic raw materials strategy must therefore focus on the design of a raw materials fund and the establishment of a European agency for strategic raw materials projects. This agency can use the resources from the raw materials fund to invest in strategic raw materials projects at an early stage and thus strengthen supply in a demand-driven market. Bonds for the agency could be taken from the Japan Organization for Metals and Energy Security (JOGMEC), but also from the Federal Agency for Leap Innovations (SPRIND), which supports projects at an early stage with a high risk affinity.

In the decade from 2030, battery raw materials from recycling will not be able to cover more than ten percent of the total raw material requirements in Europe, despite all efforts to build up recycling capacities and develop recycling technologies. The German automotive industry will continue to rely on the import of raw materials and their further processed intermediate products.

Centralized stockpiling puts additional pressure on the already scarce supply. In addition, the storage of critical raw materials and their processing is expensive or sometimes technically undesirable. Instead of investing in storage, government investments should flow into expanding the supply of strategic raw materials. In addition, private sector warehousing can receive tax incentives.

The automotive industry is actively committed to improving the sustainability, resilience and transparency of its supply chains. In various initiatives and projects, the German automotive industry is committed to increasing transparency, respecting human rights and sustainably extracting raw materials. At the same time, the industry is working on ambitious and feasible ESG standards for its supply chains. At the national level, Germany has already introduced binding due diligence obligations within the framework of the Supply Chain Due Diligence Act. In the future, there will also be a mandatory legal framework for ESG requirements in the supply chain at EU level.

However, to ensure that German car manufacturers and suppliers remain globally competitive, it is necessary to formulate clear and consistent expectations for compliance with ESG standards by companies and investors. This also requires the creation of an international, fair and sustainable market framework in the area of raw materials. In addition, the German government and the European Union should actively work to reduce global trade restrictions.

Recommendations for quality and action concerning responsible lithium mining

Lithium is a strategic raw material for the automotive industry. No electric car can currently do without lithium. Lithium therefore plays a crucial role in the comprehensive electrification of vehicles and is an essential part of the transformation in the transport sector. The extraction of lithium can bring both opportunities and challenges in the mining areas. It can create jobs, generate tax revenue and promote the development of processing industries. At the same time, however, social and environmental impacts can also occur that can negatively impact the lives of the people affected and violate their human rights.

In view of these facts, companies in the German automotive industry and other members of the automotive industry dialogue are actively committed to ensuring that preventative and remedial measures are taken. This is about protecting and respecting human rights in connection with lithium mining. The members of the industry dialogue have published cross-border recommendations for quality and action concerning responsible lithium mining. These groundbreaking recommendations were developed as part of the industry dialogue “Respect for human rights along global supply and value chains in the German automotive industry” in close cooperation between representatives from companies, business associations, non-governmental organizations and politics.

Risk-based approach as a fundament

The development of these recommendations for quality and action follows a risk-based approach upon a comprehensive analysis of the human rights risks associated with lithium mining. Taking international standards into account and in close coordination with external stakeholders, common expectations for responsible lithium mining were formulated. These recommendations for action offer German automotive companies opportunities to promote compliance with the quality standards of lithium mining companies and to support them in doing so.

After jointly developing the recommendations for action, the VDA is convinced that the published recommendations for quality and action represent an important step towards more responsible and sustainable lithium mining and will thus help to reconcile the social and ecological dimensions of this important raw material.

Read on

Division Environment & Sustainability

Michael Püschner

Head

Division Environment & Sustainability | RSCI

Nina Freund

Specialist Sustainability │Project Lead Responsible Supply Chain Initiative (RSCI)