Foreign trade

Customs and origin of goods

Customs duties and tax regulations for exports and intra-Community deliveries play a central role for the German automotive industry as the country's most important export industry.

- Topics

- Economic policy

- foreign trade

- Customs and origin of goods

Customs duties

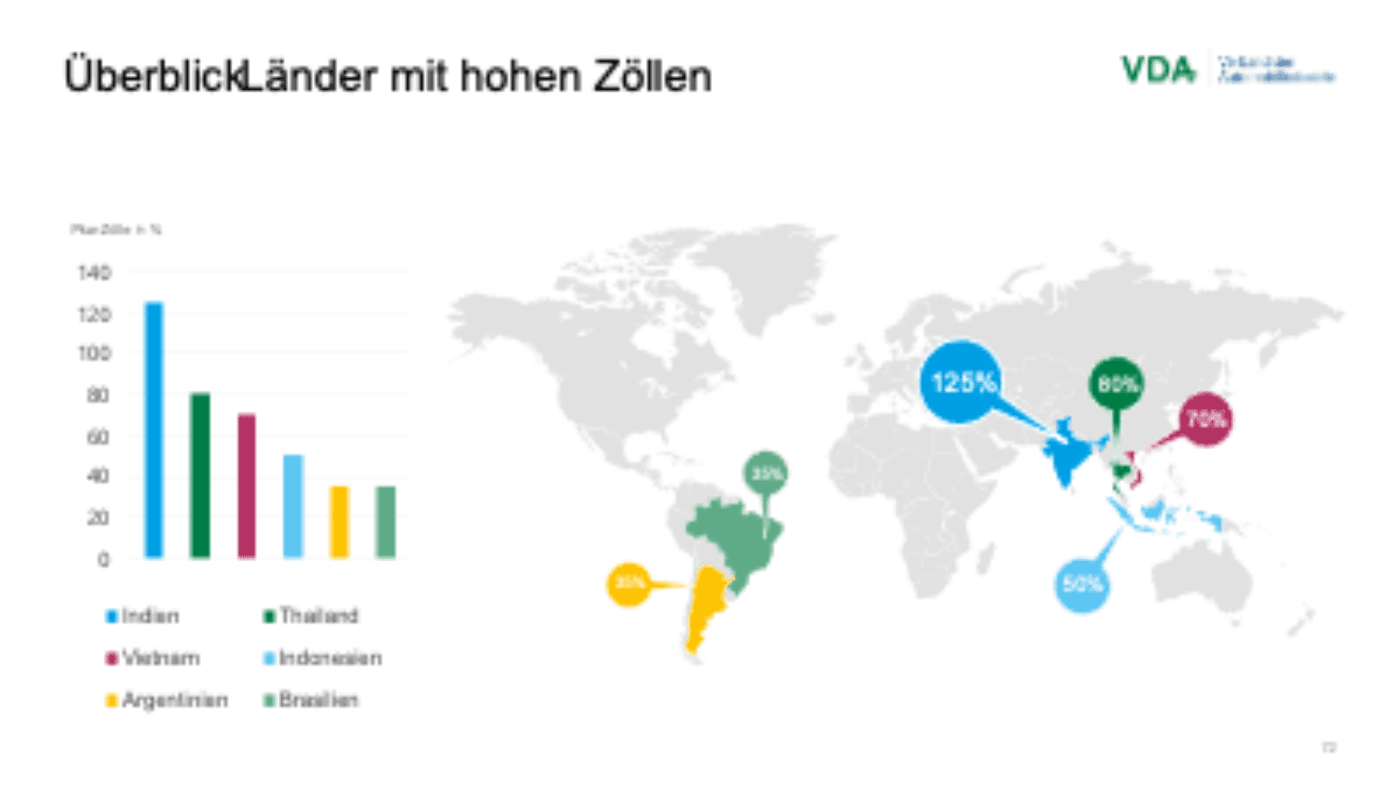

Simple and practicable customs and export regulations are necessary in the interest of competitive foreign trade. Which is why the automotive industry welcomes the inclusion of customs regulations in both existing and yet to be negotiated EU free trade agreements. Preferential agreements between the European Union and third-party countries allow companies to import and export their goods at reduced or even duty-free rates.

The VDA is in favor of dismantling existing tariff barriers and giving central importance in new agreements to preferential rules of origin that are as simple as possible. The VDA also advocates business-friendly conditions that benefit the automotive industry in regard to the coordination and discussion of numerous delegated legal and implementing acts in Union law.

Origin of goods and preferential treatment

Depending on the origin of a product, different legal consequences can can arise. This is becoming increasingly relevant for the German automotive industry, especially due to the ramp-up of electromobility. The underlying rules of origin (RoO) vary greatly from country to country and/or region to region. Preferential customs treatment for goods also plays a key role in making the trade with products in our industry as cost-effective as possible and ensuring the competitiveness of our companies.

In the context of the ramp-up of electromobility, it is particularly important to closely monitor the RoO in trade agreements and make them as realistic as possible. In view of the fact that not enough batteries are currently being produced in the EU, the special rules for batteries and cells are highly relevant for the automotive industry to enable planning and allow duty-free exports in this important segment.

VDA demands simplified customs clearance procedure based on self-assessment

The new trade agreement between the EU and the United Kingdom serves as a perfect example of this: The VDA was an early advocate here of easing the regulations for duty-free trade, primarily regarding the RoO for electric vehicles, high-voltage batteries, cells, and components. While the latest agreement managed to avoid new tariffs, the practical side of customs processing poses substantial difficulties. The VDA has long advocated a simplified customs clearance procedure based on self-assessment. This would ensure a smooth movement of goods without additional administrative effort for both the companies and the tax and customs authorities on each side of the Channel. From the VDA's viewpoint, any such simplified procedure can in general – for example, not only applicable to the EU-UK case – serve to limit the administrative burden for both companies and customs authorities, accelerate customs clearance, and increase legal certainty.

Goods with preferential EU origin can be imported into the respective countries at preferential tariffs thanks to various EU free trade agreements. To prove preferential EU origin, the EU manufacturer of the exported goods usually requires declarations from its own, upstream suppliers. In this way, the supplier confirms to their customer the origin of the (preliminary) materials delivered. The companies within the automotive industry use different software solutions for this purpose, which means that the documents or data exchanged between them sometimes differ structurally. With its Recommendation 4997, the VDA is pursuing the goal of offering an industry-wide, uniform electronic data exchange procedure and format for long-term supplier declarations. This can reduce the effort required to create, send, and process the corresponding origin information, sustainably improve data quality and timeliness, and enable automated processing of the origin information without changing media. More details on long-term supplier declarations can be found here.

Industry expertise now needed

Customs simplifications in future and existing agreements offer opportunities for the automotive industry to qualify products manufactured in the EU for the tariff benefits resulting from these agreements. Complicated rules of origin, associated with excessive bureaucracy and impossible to fulfill, are one of the main reasons for the low acceptance of FTAs. This could be significantly improved by adopting simple and practicable RoO in the future.

Industry expertise is needed to create coherent regulations that allow companies to apply them quickly and usefully. The VDA closely monitors these processes and campaigns on behalf of its members to achieve these goals.

Currently, in the EU an added value of 20% is the most that can be achieved due to the materials required. In the case of manufacturing within the EU, starting with electrode production through to the high-voltage battery, a maximum added value of 30% can currently be achieved.

Currently, in the EU an added value of 20% is the most that can be achieved due to the materials required. In the case of manufacturing within the EU, starting with electrode production through to the high-voltage battery, a maximum added value of 30% can currently be achieved.

Contact person

Angela Mans

Head of the Foreign Trade & Customs Division

Contact person

Dr. Karoline Kampermann

Head of the Economic Policy and Taxes Department